Patient profile. Consumer profile. Both terms are used in the healthcare industry today. Both terms are correct. But there are… ...

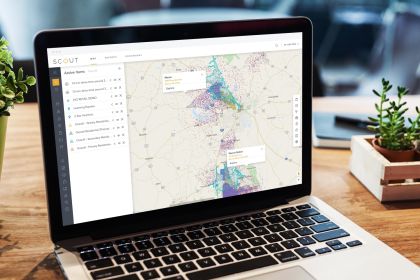

The retail location and site selection process has changed in numerous ways due to trends that have caused disruption in… ...

One of the most important parts of any business is understanding who your customer is, and one of the best… ...

Sales forecasting is the process of using past performance data to inform future performance. It’s become an increasingly common element… ...

Site selection has traditionally been viewed as a tactical activity. If a business needs to open 30 more units next… ...

If you’ve ever considered purchasing a real estate site selection model, you know that the industry is filled with unfamiliar… ...

As the healthcare industry continues to shift to a consumer-centric strategy, a growing number of providers are implementing site selection… ...

The rise of urgent care in the U.S. is one of the key trends that has dominated healthcare news headlines… ...