The rise of urgent care in the U.S. is one of the key trends that has dominated healthcare news headlines in recent decades. The growth in urgent care clinics also comes with a need for new strategies to successfully navigate the urgent care business model – including insights on urgent care site selection.

Traditional health systems have historically relied on an “if you build it they will come” approach to real estate. Medical services are concentrated in a specific area, and patients are expected to travel to that area for treatment.

But the urgent care business model reverses the traditional healthcare real estate paradigm. Rather than building a large medical center in a central location, urgent care providers need to build a network of small clinics that are strategically positioned to reach patients where they are. In this blog, we’ll show you why selecting the right sites is fundamental to an urgent care provider’s success.

1. Great Urgent Care Sites Have the Right Types of Consumers in the Trade Area

Businesses cannot survive without customers, and urgent care clinics are no exception. Great sites have the right concentrations of the right types of consumers within the trade area.

But how exactly do you define what the “best type of consumer” is for your urgent care practice? One approach is to use demographic information. For example, you may look for sites that are near high concentrations of families with children. Median income is another demographic metric you may consider.

While demographic information is helpful, it doesn’t tell the full story. Ultimately, you need to know which types of consumers are likely to choose urgent care for their healthcare needs. This is measured by lifestyle metrics called psychographics. Combining demographic and psychographic information through consumer profiling gives you a clear understanding of who your clinics are trying to reach and allows you to identify where pockets of those target consumers are concentrated.

Related: Trade Area Analysis: How Well Do You Know Your Market?

2. Great Urgent Care Sites Offer High Impression Frequency

Impression frequency is a term used in marketing to describe the number of times a consumer is exposed to a brand name. To capture distracted consumers’ attention, you need to regularly put your brand name in front of them to be top of mind when they need your type of services.

Many don’t realize that impression frequency is driven by more than advertisements. In fact, one of the most important sources of impression frequency are brick-and-mortar locations.

Since urgent care is a convenience-based brick-and-mortar business, impression frequency is critical to success. Selecting high-visibility sites and leveraging well-placed signage that prospective patients will pass regularly during their daily commute or errands helps to ensure that your clinic is the first that comes to mind when they need healthcare services.

Measuring impression frequency is difficult, but there are some proxies you can consider instead:

- Look for sites with complementary co-tenants. Analyzing your existing location performance can provide insights into whether being located near certain types of businesses helps your business. Perhaps being located in the same shopping center as a grocery store is a strategy that works well for reaching your particular patient base. Moreover, co-tenants like pharmacies, gyms, and grocery stores often draw health-conscious or family-oriented customers who are likely to visit urgent care facilities.

- Consider traffic counts and area draw. The higher the traffic in the area, the higher the impression frequency. Traffic counts are one metric to consider, as is the gross leasable area (GLA) of the center you are considering. In general, the larger the center, the higher the assumed traffic volumes. Locations near major intersections, highways, or busy shopping centers further enhance exposure. Additionally, signage visibility plays a crucial role—factors like size, lighting, and clear placement improve recognition, making it easier for patients to locate your facility. By optimizing both traffic exposure and signage, urgent care clinics can increase spontaneous visits and build brand awareness.

3. Great Urgent Care Sites Have the Right Balance of Supply and Demand in the Trade Area

Another fundamental of urgent care site selection is ensuring that the site offers the right balance of supply and demand. An area may have high consumer demand for urgent care services, but if the market is already saturated with other providers, it will be difficult to succeed there. High market saturation dilutes patient volumes, while low saturation often indicates untapped demand.

Assessing saturation involves identifying the number of existing urgent care centers, primary care offices, and other medical facilities within a specific radius. Where there is competition, there is often less opportunity for new entrants to capture market share, making it critical to assess both current provider saturation and unmet demand before committing to a site. Analytic platforms that allow you to analyze a market and visualize competition can help pinpoint areas with the right balance of competition and demand. By choosing a market with low saturation, urgent care providers can establish a foothold in underserved areas, increasing their chances of success and sustainability.

Healthcare demand can be measured through use rate information, which is a summarized and more user-friendly version of raw claims data. Supply can be measured through counts of existing facilities and full-time employees (FTEs) by type.

4. Great Urgent Care Sites Excel at Real Estate Fundamentals

While there are many quantitative factors that drive real estate performance, don’t overlook the importance of qualitative factors in site selection. Just as you would interview a job candidate who “looks good on paper,” visit each potential site in person to ensure that it truly is a good fit.

Great urgent care sites are easy to access, have sufficient parking or access to mass transit, and have good visibility and signage placement. They also are near co-tenants that attract similar foot traffic and may be located in retail centers with high traffic and visibility. Additionally, deciding between a stand-alone facility versus an in-line retail space is a key consideration. While stand-alone buildings may offer stronger branding and visibility, they typically come with higher costs.

Finally, evaluating the trade-offs between leasing versus purchasing a property should align with your long-term business strategy. Leasing provides flexibility, especially for expanding providers testing new markets, whereas purchasing offers long-term stability and investment potential.

By considering both quantitative site data and real estate fundamentals, urgent care providers can ensure their locations are well-positioned for success.

Other Success Factors to Consider When Selecting an Urgent Care Site

Successful urgent care site selection requires more than the essentials. Consider these additional factors:

1. Location Success Forecast

Ultimately, the point of all this analysis is to determine the expected financial performance of a new location. Predictive analytics can evaluate metrics like demographics, psychographics, competition, area draw, cotenants, and other factors that correlate with performance to forecast a site’s success. These tools also assess healthcare needs, identifying areas with high demand for urgent care services. For example, areas with rapidly growing populations often signal future increases in patient volumes. By incorporating predictive insights into your strategy, you can further vet locations to assess the likelihood of long-term profitability.

2. Employment Density

While residential population density might be the first factor that comes to mind when you think about access to potential patients, employment density also directly impacts patient volumes for urgent care centers. High employment density boosts weekday visits from workers at nearby businesses.

Beyond patient volume, workforce availability is another critical factor. Labor shortages in the healthcare industry make it essential to locate facilities where there is an adequate supply of healthcare professionals. Proximity to medical training institutions, hospitals, or regions with a strong healthcare workforce can enhance staffing capabilities and reduce hiring challenges.

Evaluating employment density alongside demographic and psychographic data ensures that your clinic is positioned to serve both patient demand and operational staffing needs effectively.

3. Urgent Care Site Aesthetics

A well-designed, modern clinic fosters trust and encourages repeat visits. Consider investments in a clean, welcoming exterior, professional signage, and an inviting interior layout. These elements improve the patient experience and enhance your clinic’s reputation. A comfortable waiting area and efficient layout also streamline patient flow, creating a positive first impression that can set your facility apart from competitors.

4. Payer Penetration

Understanding the local insurance landscape is vital for sustaining patient volume. You need to understand whether the payer mix in the trade area around a potential urgent care location matches your business model. If you cater to Medicare/Medicaid patients but the trade area is primarily composed of privately insured consumers, then the site is likely not a good fit for you. This data can also guide pricing strategies and service offerings, helping to meet the needs of the local population effectively.

Related: Why Strategic Site Selection Matters in Urgent Care

How Buxton Simplifies the Urgent Care Site Selection Process

While the list above isn’t comprehensive, it’s easy to see that urgent care site selection involves many factors. Evaluating each of those factors can be time-consuming, but you can simplify the process using site selection analytics.

Rather than manually tracking the individual metrics outlined above, you can combine them into a site selection model. The model allows you to quickly score a potential site to see how it rates in certain key variables – from core consumer density to competition. When combined with your own qualitative site research, a site selection analysis solution can give you increased confidence in your urgent care site selection process.

Below are the building blocks that make up Buxton’s site selection analysis solutions for healthcare:

Consumer Profiling

The consumer profile defines your core patient to help you understand, at a household level, who your best consumers are, where more people just like them are located, and the value they bring to your organization.

Using the Mosaic 71 segmentation system and Buxton’s extensive data on 120 million households combined with your patient data and performance records, these profiles define your best consumers at the household level. This helps you better understand your patients’ demographics, psychographics, marketing and media consumption preferences, and more.

Profiles can be developed at the overall level or at the subcategory level, with the latter offering a clear comparison of where different patient types reside. By visualizing these patient populations and identifying where there are areas of high concentrations of the ideal patient, healthcare organizations can strategically expand where they are most needed.

Not ready to share your patient data for analysis? Buxton can use our proprietary urgent care industry consumer profile instead.

Trade Area Analysis

Trade area analysis – an important step in Buxton’s site selection analysis – evaluates the potential patient density in a region and determines how far individuals are willing to travel to a specific location. Incorporating trade area analysis into your site selection strategy allows you to optimize healthcare facilities planning processes by ensuring facilities are strategically placed to meet demand and improve overall accessibility.

Site Scoring Models

When it’s time to make an important real estate decision, a site score model gives you the unbiased, data-backed validation you need to have confidence in moving forward. Buxton’s models incorporate factors like healthcare demand, population metrics, area draw, and relevant competition to evaluate site potential. Buxton offers an off-the-shelf urgent care industry site score model subscription developed based on our industry experience, which offers fast implementation without requiring the incorporation of first-party datasets. Alternatively, Buxton can scope custom models tailored to a specific organization.

Regardless of which modeling approach you decide, our models are designed to help you open home run new locations and avoid expensive mistakes.

Rapid Evaluation Tools

Buxton's rapid evaluation tools streamline the site selection process for healthcare organizations, minimizing risk and reducing decision time. With advanced mapping and reporting software, users can quickly assess site viability by analyzing critical factors like patient demographics, competition, and healthcare demand. These tools offer on-demand insights through detailed maps and reports, and also integrate with site selection models, enabling decision-makers to make informed choices faster. By cutting down the evaluation timeline, healthcare providers can focus on choosing the best locations for new facilities or expansions, improving overall operational efficiency.

Buxton’s tools help reduce uncertainty and ensure data-driven site decisions, empowering healthcare organizations to confidently optimize their growth strategies.

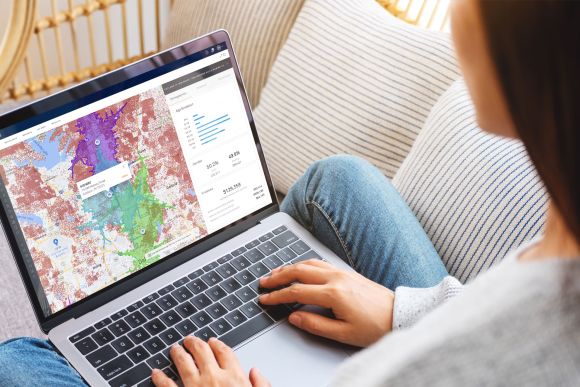

Integration with SCOUT

Buxton integrates our healthcare analytic solutions – profiles, trade area analysis, and models – into SCOUT, our mapping and geographic reporting application, which helps streamline the site evaluation process. This geospatial tool enables healthcare organizations to visualize potential facility locations, assess market conditions, and optimize site decisions on demand.

With SCOUT, users can explore key demographic, psychographic, and demand data to make informed, data-driven choices. Buxton’s solutions provide ongoing market planning support, ensuring that site selection is both strategic and responsive to changing market dynamics.

Learn more about Buxton’s location intelligence solutions.