Key Takeaways

With mobile data analytics, tourist destinations are pinpointing exactly who their core customers are and where they live.

Armed with a clearer appreciation of who is visiting their attraction, hotels, sports and concert arenas, theme parks and other key destinations are better allocating marketing dollars to increase return on investment and reduce waste.

Mobile data offers unprecedented precision and insights.

It’s Time for Venues to Get a True Customer Picture

Everyone knows the adage, "I know half my advertising spend is wasted, I just don’t know which half."

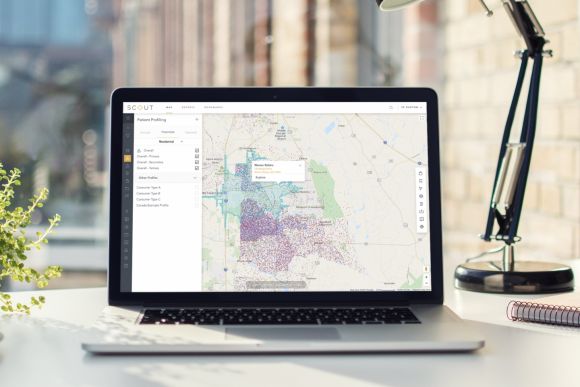

But marketers no longer need to throw darts in the dark, hoping they hit their intended targets. With mobile GPS data from Buxton, the new watchword is precision.

Until recently, owners and operators of theme parks, sports stadiums, theaters, hotels and other tourist attractions had a tough time building an accurate profile of their core customers, detailing information such as where they travel from, how often they visit, where they stay and for how long, what else they do when they’re in town, and more.

In the past, it was at best possible to determine where visitors come from and where they go at a ZIP code level, typically using credit card data. So if, for example, the Dallas Cowboys wanted to profile a typical AT&T Stadium visitor, the data might also pull in the adjacent Texas Rangers’ Globe Life Park and the nearby Six Flags Over Texas theme park, which share the same 76011 ZIP code. This made it difficult — if not impossible — to determine with any certainty who attended which of these major destinations.

It was a similar story for the visitor’s point of origin, as ZIP codes can include multifamily homes, starter homes, retirement communities and McMansions all within a block or two of each other, making it tough to pinpoint where any potential Cowboys fan actually lives.

Increased Accuracy

But mobile devices generate data that can be analyzed along with other metrics to create a more accurate and detailed picture of tourists, down to an individual household level, which can help owners and operators of attractions better target their marketing dollars.

Ask any attraction owner where their customers originate and you’re likely to get a response like "Folks come all the way from Alaska.” That’s because everyone remembers the exception, the outlier, but to base marketing decisions on such anecdotal observations would be foolhardy.

While attraction operators or city tourism offices may think they know where their visitors live, the data likely show a very different — and much more accurate — reality.

Precise Targeting

Visit Frisco wanted a better understanding of where day trippers and overnighters come from, in part to determine whether the money that the town north of Dallas spends on marketing lists is worth it.

Buxton’s research revealed that 80% of the people on the first lead list purchased were unlikely to visit the town, a result worse than might be expected from a random distribution of households, meaning the bureau could have been better off just by guessing.

Buxton used mobile location information in conjunction with other analytics tools to anonymously identify key traits of the people who actually visited the town, including sites such as the new $1.5 billion Dallas Cowboys training complex dubbed The Star. That allowed them to build an accurate picture of the city’s core customers, allowing Frisco to precisely target populations with a stronger likelihood of taking a trip to the city.

Musical Tastes

In a similar exercise, the operators of a new 14,000-seat multi-use arena owned by the city of Fort Worth that will stage concerts and other events including the Fort Worth Stock Show & Rodeo wanted to analyze visitors to the American Airlines Center 35 miles away near downtown Dallas to help determine which events likely appeal to residents in the west side of the metroplex.

Buxton discovered that between 23% and 40% of those attending concerts at the American Airlines Center came from the Fort Worth area, giving management of the new venue valuable clues about demand in their target area. The analysis also revealed that locals favor country and rock music over hip-hop, dance, pop, and indie bands, giving the venue operator further insight into the genres that appeal to core customers.

Beyond Demographics

Mobile data analysis means analysts now have the ability to go beyond demographic information such as age, sex, and income to provide a more granular view of individual lifestyles and behaviors that are relevant to a business’ core customer metrics.

Armed with such insights, marketers can discover whether they are truly targeting the right people in the right places. They can determine whether their advertising and promotional work appeals to people who visit a gym twice a week and travel to indulge hobbies such as hiking, biking, and skiing; if they are more likely to cook at home or eat out at a fast-casual restaurant three times a week; or even what type of concerts they go to.

It’s a layer of detail that simply wasn’t available before.

So when city tourism offices and attraction owners need to know exactly who their core customers are and where they come from, they can use location data mobile to pinpoint these traits, or keep guessing and hope that only half of their precious advertising spend is wasted.

For more information about mobile GPS data, check out Mobilytics.