Retail / Restaurant / Healthcare / General / Hospitality

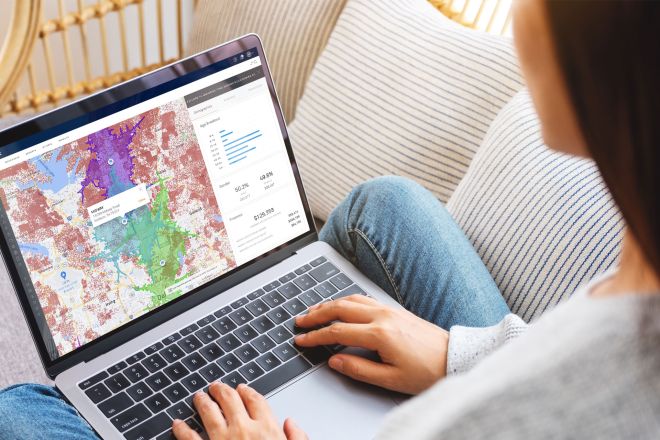

Your Guide to Location-Based Analytics

...

...

The rise of urgent care in the U.S. is one of the key trends that has dominated healthcare news headlines… ...

It’s classic business wisdom: when defining your strategies and tactics, you need to understand the competitive environment. No business operates… ...

Consumer demands for convenience are putting pressure on the retail, restaurant, and healthcare industries to adapt. With more and more… ...