KEY TAKEAWAYS

- Mobile location data highlights stark differences in the brand choices of college football fans, even those in close geographic proximity.

- By better identifying their real customers and getting a deep insight into their preferences, companies can target them more efficiently.

When it comes to identifying and targeting customers there’s little to be gained by fretting over potential differences between groups with a common attribute or passion, like fans of college football. Right?

For example, why would there be any significant disparity between the choices made by Iowa State Cyclones and Iowa Hawkeyes fans? Everyone knows all Iowans — without exception — are very nice farmers who believe dinner must always include corn and beef, and that it ain’t music if it ain’t country. These are traits that all Iowans share.

Except that they don’t.

And to show why lumping consumers together based on nothing more than one shared quality or virtue can lead to false assumptions about their buying habits and lifestyles, Buxton used its Live Mobile Insights platform to analyze anonymized location data from mobile devices to determine where Hawkeyes and Cyclones fans shop, eat and sleep when traveling.

Iowa State hosts the 63rd meeting with Iowa on Sept. 14 at its 61,500 capacity Jack Trice Stadium. The Cyclones are seeking to arrest a four-game losing streak that gave the Hawkeyes a 44-22 lead in the series, which dates back to 1894.

For the purposes of the exercise, the first of a series of regular analyses being branded as the College Game Day Fan Matchup, Buxton defined a fan as someone who has been observed attending a home football game and who also lives within 50 miles of Iowa State’s stadium in Ames or Iowa’s stadium in Iowa City. To ensure accurate comparisons, data were adjusted to reflect the presence of a brand within the 50-mile zones.

The results were then compared against the average fan — defined using the same parameters — of teams in nine major college football conferences including the Atlantic Coast and Southeastern, whose schools include reigning national champion and top-ranked Clemson and No. 2 Alabama, which won the National Collegiate Athletic Association title in 2017 and 2015.

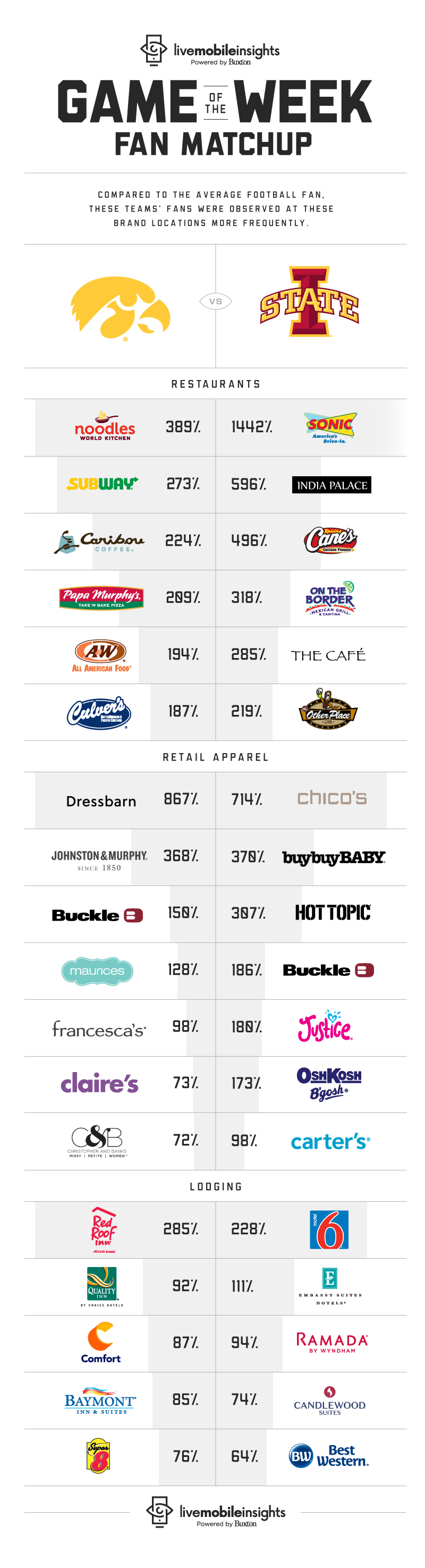

The analysis of footprint traffic revealed stark variations in the eating, shopping and travel choices of the two groups. For example, when it comes to restaurants, there is no overlap at all in the top 10 brands favored by each.

Iowa fans are almost four times more likely than the average college football fan to choose Noodles & Company, which has 10 locations in the state, and are almost three times as likely as the average to visit a Subway.

Fans of Ames-based Iowa State, however, are almost 15 times more likely than the national average for college football fans to eat at one of the three Sonic locations around the Des Moines area, within 50 miles of the school, and are five times more likely to eat at their No. 3 choice, Raising Cain’s, which has two locations in Des Moines.

While Hawkeyes gravitate toward larger brands such as A&W Restaurants, Papa Murphy’s, Caribou Coffee and Culver’s, Cyclones prefer locally owned operations such as Indian Palace, The Cafe, The Other Place and El Mariachi, or smaller chains like Baker’s Square, which has 32 outlets in the Midwest, including one in Iowa.

So just on this single measure, the data show a significant disparity between the two sets of fans, even though the schools are just 125 miles apart.

The distinctions extend to other categories.

Women account for about 44% of college football fans and five of the top seven apparel and accessories choices for Hawkeyes fans are women’s brands — Dressbarn (which is going out of business by the end of the year, closing all its roughly 650 outlets), Maurice’s, Francesca’s, Claire’s and Christopher & Banks.

But only Christopher & Banks and Claire’s appear among the top apparel choices of Iowa State supporters. Instead, that list is dominated by baby, toddler and kids’ outfitters Chico’s, buybuy Baby, OshKosh B’Gosh and Carter’s, along with Justice and Hot Topic, which target tweens and teenagers, a slight skew toward young families that Buxton confirmed using its unique household level segmentation data.

The only apparel brand in each team’s top 10 is Buckle and it’s a similar story in lodging, where only Drury Hotels appears in both lists.

Each set of fans favor budget hotels, with Red Roof Inn the No. 1 choice of Hawkeyes and Motel 6 the top choice for State followers.

But again, there’s little overlap, with names including Quality Inn, Country Inn & Suites by Radisson, Baymont Inn & Suites and Super 8 being popular choices for Hawkeyes, while Embassy Suites, Ramada, Candlewood Suites and Best Western are preferred shelters for Cyclones.

So while the conventional wisdom is to treat college football fans as one homogenous cohort, there are in fact significant variances in the retail, dining and hotel brand preferences of fans — even those who follow teams in close proximity to each other.

So rather than assuming that those who share a trait are all the same, companies can gain a much more accurate insight into exactly who their true customers are by analyzing foot traffic generated from mobile device location data. By combining that with additional demographic and financial insights, it’s possible to make more informed decisions about where and how to invest to optimize returns.

For more information about Buxton’s Live Mobile Insights platform, call (817) 332-3681.

Buxton is the industry leader in customer, tenant and property analytics specializing in the retail, restaurant, healthcare, public, and commercial real estate property technology sectors. We advise clients on real estate and marketing strategies based on trillions of consumer and location data points.

At Buxton’s core, we help businesses, property owners and investors realize their growth and optimization potential by understanding who the relevant customers are, where existing and potential customers are located and the value each customer brings to the organization. For 25 years we have produced award-winning solutions for our clients, enabling them to successfully expand and improve the sales performance of their existing portfolio of locations. Buxton’s solutions have provided confidence to our clients in their expansion efforts, allowing them to grow faster and more effectively than their competition. Buxton is privately held and offers solutions globally in over 200 countries and territories.