Getting ahead of the growing competition in today’s healthcare marketplace is more challenging than ever before.

As more non-traditional providers enter the market and strive to meet consumer demand for ease of access and convenience, established healthcare networks need to take note. Compound new competition with limited capital, this leaves health systems with a challenge to maintain market share.

While expansion may not be an option, there are steps you can take to maximize your existing locations to drive growth. Ask these questions to improve your existing location portfolio:

Are My Facilities Still in the Right Locations?

The old model of healthcare where opening a new facility in an area of high-demand and low competition meant the patients would come to you. But as competition increases and market migration occurs, it's time to reevaluate existing facility locations and determine if they still support the market demands.

Understanding the market demand density and nearby competition will help you determine which facilities are ripe for growth and which may be in need of relocation or potential closure due to decreased demand.

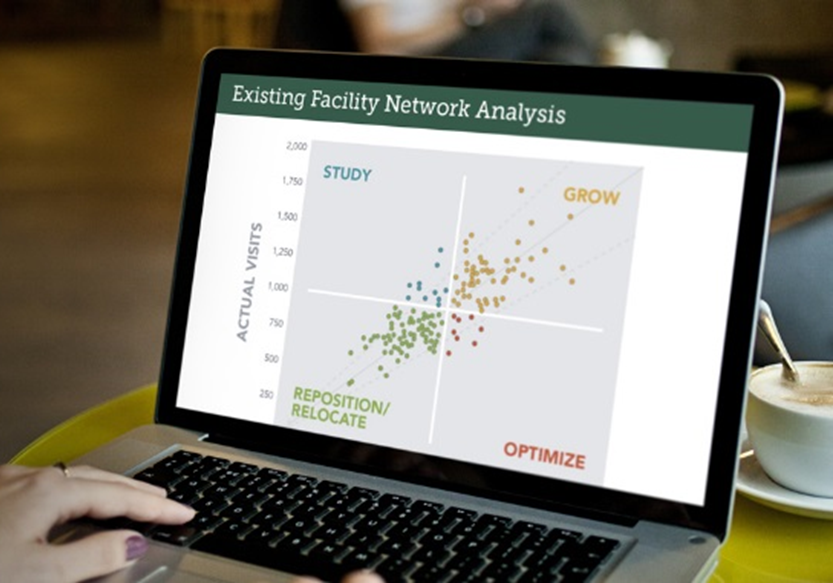

Use consumer data and analytics to uncover insights on patient behavior to determine which facilities should be repositioned or relocated, optimized, updated or maintained. A thorough analysis, added to a real estate assessment, will help you understand if a location is in need of a remodel or needs to be relocated. An existing facility network analysis will help you determine which facilities are not worth further investment and how best to apply your budget toward locations primed for growth and expansion opportunities.

Am I Offering the Right Service Lines at Each Location?

After evaluating your existing location performance, you may have identified which are underperforming. Before closing their doors for good, evaluate whether your service lines match the medical needs in the area. Maybe the existing facility was once a prime location for pediatric services, but due to changes in the market and migration it may be a better fit for internal medicine, cardiology or geriatrics.

Understanding which service lines are best suited for each trade area could help you optimize your existing locations to better meet the needs of the patients that are most likely to visit that facility. Read our recent post “How to Maximize your Healthcare Assets Through Service Line Growth” for more insight on optimizing existing locations to meet market demand.

Am I Marketing to The Right People Around Each Facility?

After you’ve taken the time to analyze existing locations and reposition facilities with new or additional service lines to meet market demand, it’s time to evaluate whether your marketing is reaching the right households. Consumers have more options than ever when it comes to care, so take time to let them know you now have the services they are looking for.

Understand the lifestyle behavior of your existing patients through consumer analytics and uncover where to find more prospective patients just like them in your service areas. Consumer analytics will help you identify key points of entry for patients in the lifecycle of care and how to reach them through targeted marketing to increase their lifetime value. Predictive modeling and consumer analytics can help you drive new patient volume and increase marketing return on investment.

Improve Performance at Existing Locations

Watch our webinar for a deeper look at insights on “Maximizing Assets: Getting the Most Out of Your Existing Facilities.”